Market Review and Outlook

You Missed the October 15 Deadline to Correct an Excess IRA Contribution – Now What?

By Sarah Brenner, JD

Director of Retirement Education

October 15, 2024 has come and gone. This was the deadline for correcting 2023 excess IRA contributions without penalty. If you missed this opportunity, you may be wondering what your next steps should be. All is not lost! While you may not have avoided the excess contribution penalty for this year, you can still correct the issue for future years.

Excess IRA Contributions

Maybe your income ended up being higher than expected and you were ultimately ineligible for the Roth IRA contribution you made. Maybe you did not have earned income and contributed to an IRA anyway. Excess IRA contributions can happen in all sorts of ways. The cutoff for removing an excess IRA contribution for 2023 without penalty was October 15, 2024.

Two Options for a Fix After the Deadline

Regardless of the reason, if there is an excess IRA contribution it can still be corrected after the deadline. One way to fix the problem is to withdraw the contribution from the IRA. The good news is that only the excess contribution amount needs to be withdrawn. When correcting an excess before the October 15 deadline, any net income attributable (NIA) must also be withdrawn. However, in an odd tax code anomaly, since we are after the deadline, the NIA to the excess contribution can remain in the traditional or Roth IRA.

The bad news is that there will be a 6% excess contribution penalty, and IRS Form 5329 will need to be filed to pay it. Fixing the excess contribution is still the smart thing to do because if the excess contribution is not fixed – the 6% penalty will continue to accrue each year until either the excess is corrected, or time runs out under the new SECURE 2.0 statute of limitations (six years).

Besides withdrawal, there is another option to correct excess IRA contributions after the deadline. You can elect to carry forward the excess and apply the overage to future years. To use this method of correction, you must be eligible to make the contribution in the future year(s), and the 6% penalty must be paid each year until the original excess contribution amount is used up or the statute of limitations runs out.

https://irahelp.com/slottreport/you-missed-the-october-15-deadline-to-correct-an-excess-ira-contribution-now-what/

Nuances of NUA

We have written about the net unrealized appreciation (NUA) tax strategy many times. Generally, after a lump sum distribution from the plan, the NUA tactic enables an eligible person to pay long term capital gains (LTCG) tax on the growth of company stock that occurred while the stock was in the plan. But there are finer points to NUA. Here are some more nuanced details:

Step-Up in Basis. NUA (meaning the appreciation that occurred in the plan prior to the lump sum distribution) never receives a step-up in basis. If the company stock is still held by the former plan participant upon his death, the beneficiary of that account will pay LTCG tax on the NUA no matter when the shares are sold. But what about any appreciation of the stock AFTER it was distributed from the plan? Appreciation after the lump sum plan distribution DOES receive a step-up in basis.

Example: John completed a proper NUA distribution 10 years ago of his company stock that was valued at $500,000. At that time, John paid ordinary income tax on the cost basis of his shares ($100,000) and he anticipated paying LTCG tax on the NUA of $400,000 when he sold the shares. John held all the shares until his death, when the total value had increased to $750,000. John’s beneficiary (his daughter Susan) immediately sells the shares. She will pay LTCG tax on the $400,000 of NUA. However, Susan will get a step-up in basis on the $250,000 of additional appreciation and owe no tax on that part of the transaction. (The original $100,000 is also tax-free as a return of basis.)

“Specific Identification Method.” Retirement plans will typically use an “average cost per share” to determine the NUA. Over the years, as the company stock price goes up and down, a plan participant will acquire shares at different price points with each salary deferral. However, the plan may not track all these different purchase prices. Instead, the plan could use the total purchase amount (the cost basis) vs. the current value of the stock. For example, if the current value of the stock within a 401(k) is $1,000,000, and if the total amount used to purchase the stock was $400,000, the NUA is $600,000. Average cost per share is cost basis ($400,000) divided by the total number of shares owned within the plan.

If a plan participant maintains detailed records and documents the specific historical stock purchase prices, the person could decide to only include the low-cost-basis shares in an NUA transaction. The high-cost-basis shares would be rolled to an IRA and excluded from the NUA calculation. By following the “specific identification method” and targeting the low-basis shares, a person could further maximize the NUA tax strategy.

In-Plan Roth Conversions: Caution! When an NUA “trigger” is hit, a plan participant does NOT have to act immediately on an NUA distribution. However, if the trigger is “activated” by certain transactions – like a normal distribution – the NUA lump sum withdrawal must occur within that same calendar year. If not, the trigger will be lost. Be careful! An in-plan Roth conversion is considered a distribution and WILL activate an NUA trigger.

10% Penalty for Those Under 55 Years Old. Assume a plan participant was under 55 at the time of separation of service. As such, she could not leverage the age-55 exception to avoid a 10% early withdrawal penalty. But there is a silver NUA lining. If she pursued an NUA transaction before age 59 ½ (and rolled over her non-stock plan funds), she would owe a 10% penalty ONLY ON THE COST BASIS of shares. If the appreciation is high enough, it could be advantageous to pay the 10% penalty on the cost basis to preserve the LTCG tax break on the NUA.

The NUA tax strategy is part art and part science. To maximize the benefits, understanding the different nuances is essential.

https://irahelp.com/slottreport/nuances-of-nua/

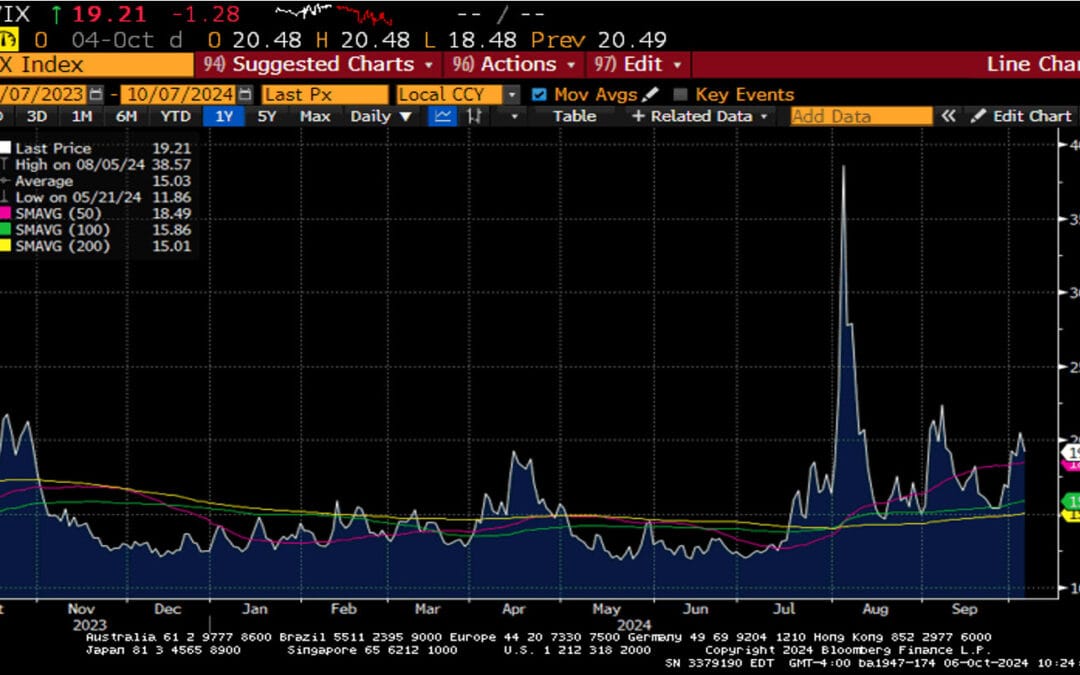

Weekly Market Commentary

-Darren Leavitt, CFA

The S&P 500 and Dow Jones Industrial Average forged another set of all-time highs despite facing several macro headwinds. Chinese markets reopened after celebrating Golden Week with significant losses. Investors were expecting an announcement with more significant stimulus initiatives. Still, the initial stimulus amount fell short of market expectations and hit shares on Hong Kong’s Hang Seng (-6.5 %) and the Chinese Shanghai Composite (-3.6%). Investors also had to contend with Hurricane Milton devastating parts of Florida after Helene’s horrific destruction across the southeast. The fallout from these storms will profoundly affect regional economies, influencing economic data sets for several months. Our prayers and thoughts go out to those affected by the hurricanes. Investors were also focused on the direction of monetary policy. Expectations of further rate cuts have been tempered after the stronger-than-anticipated September Employment Situation Report.

The minutes from last month’s Federal Reserve’s Open Market committee meeting yielded very little incremental information but indicated some pushback on cutting by fifty basis points. Inflation data reported this week came in a bit hotter than expected, strengthening the argument for less aggressive policy easing. There was plenty of corporate news to digest as the third-quarter earnings season kicked off. The financials led markets higher on Friday after JP Morgan, Wells Fargo, and Blackrock earnings were cheered by Wall Street. Other notable corporate news included the Department of Justice’s intentions to break up Alphabet (Google), Wells Fargo’s downgrade of Amazon due to worries about future margin compression, and Tesla’s disappointing/underwhelming Robo-Taxi launch event.

The S&P 500 gained 1.1% as Goldman’s CIO Kosten and Morgan Stanley’s Market Strategist, Mike Wilson, increased their 12-month S&P 500 forecasts higher. The Dow advanced by 1.2%, the NASDAQ added 1.1%, and the Russell 2000 increased by 1%. The yield curve continued to steepen, with shorter-tenured Treasuries outperforming their longer-duration counterparts. The 2-year yield increased by one basis point to close at 3.94%, while the 10-year yield rose by nine basis points to 4.07%.

Oil prices extended recent gains on continued tensions in the Middle East. An Israeli attack on Iranian energy infrastructure is likely and was considered eminent last week after Israel’s defense secretary canceled a scheduled trip to Washington. West Texas Intermediate crude prices increased by $1.06 or 1.4% to $75.46 a barrel. Gold prices increased by $6.90 to $2675.80 an Oz. Copper prices fell by $0.08 to $4.40 per Lb. Bitcoin gained ~ $1000 to close at $62,916. The US Dollar index advanced by 0.4% to 102.86, with a noticeable weakness in the Japanese Yen, which closed at 149.09.

The Economic calendar featured two measures of inflation. Headline CPI increased by 0.2%, above the consensus estimate of 0.1%. Core CPI, which excludes food and energy, increased by 0.3% versus the forecast of 0.2%. On a year-over-year basis, headline CPI increased by 2.4%, while Core CPI advanced by 3.3%. Interestingly, the shelter component of the data series showed declines, something we have not seen for quite some time. The producer Price Index (PPI) was flat versus an anticipated increase of 0.1%. Core PPI increased by 0.2%, in line with the consensus estimate. On a year-over-year basis, the headline PPI increased by 1.8% while the Core figure advanced by 2.8%. Initial Jobless Claims surprised to the upside with an increase of 33k to 258k, while Continuing Claims rose by 42k to 1861k. Some of the uptick in Initial Claims may be related to Hurricane Helene. A preliminary look at the University of Michigan’s Consumer Sentiment fell to 68.9 from 70.1 due to continued frustration with elevated prices.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

The 10-Year Rule and Required Minimum Distributions: Today’s Slott Report Mailbag

By Andy Ives, CFP®, AIF®

IRA Analyst

QUESTION:

Good afternoon,

If a client passed this year with four adult children inheriting equally, and each beneficiary is using the 10-year rule, how do they determine yearly required minimum distribution (RMD) calculations? Is it based on life expectancy or on a number that will empty the IRA within the 10 years?

Thank you for your help.

Sherry

ANSWER:

Sherry,

When RMDs apply within the 10-year period (and assuming the four inherited IRAs are properly established), each beneficiary will use his own age to determine the appropriate RMD. Use the beneficiary’s age in the year AFTER the year of death (2025) to determine the initial factor from the IRS Single Life Expectancy Table. Then, subtract 1 from that factor for years 2 – 9 of the 10 years, and deplete the entire account by the end of year 10 (12/31/34). A beneficiary can always take more than the RMD, which could be a wise tax-planning decision.

QUESTION:

My wife’s mom, age 96, died in June and still has about $6,000 in IRA assets. She had been taking required minimum distributions (RMDs). Do we need to take an RMD for her in 2024, or can the remaining funds pass to her beneficiaries?

Thanks,

Michael

ANSWER:

Michael,

All (or whatever portion remains) of your mother-in-law’s year-of-death RMD becomes the responsibility of the beneficiaries. To avoid a late penalty, Mom’s final RMD must be taken by December 31 of the year AFTER the year of death (12/31/25) – this is the new extended deadline. To help streamline tax reporting, a custodian will typically establish an inherited IRA for the beneficiary and pay the year-of-death RMD from that inherited account. Note that if there are multiple beneficiaries, the year-of-death RMD does not need to be spread equally among them. As long as the full amount is taken, the IRS will be satisfied.

https://irahelp.com/slottreport/the-10-year-rule-and-required-minimum-distributions-todays-slott-report-mailbag/

Tax Filing Relief and Retirement Account Withdrawal Options for Hurricane Victims

By Ian Berger, JD

IRA Analyst

Victims of Hurricane Helene have at least a glimmer of good news when it comes to their tax filings and ability to withdraw from their retirement accounts for disaster-related expenses.

The IRS usually postpones certain tax deadlines for individuals affected by federally-declared disaster areas. On October 1, the IRS announced disaster tax relief for all individuals and businesses affected by Hurricane Helene, including the entire states of Alabama, Georgia, North Carolina and South Carolina and parts of Florida, Tennessee and Virginia. Generally, the IRS extended the deadline to file certain individual and business tax returns and make tax payments until May 1, 2025. It is likely the IRS will provide similar relief for victims of Hurricane Milton.

Meanwhile, as a result of SECURE 2.0, victims of federally declared-disasters (such as Hurricanes Helene and Milton) can withdraw up to $22,000 from their IRAs. If you are under age 59 ½, you won’t have to pay a 10% early distribution penalty on these withdrawals. Further, the taxable income on these withdrawals can be spread over three years, and the funds can be repaid over three years. Your employer plan may also allow these withdrawals. Even if your plan doesn’t allow disaster-relief withdrawals, you may be able to treat a hardship withdrawal (see the last paragraph of this article) as a disaster-relief withdrawal on your federal tax return – this would allow you to avoid the 10% penalty, spread income over three years and repay the withdrawal.

SECURE 2.0 also allows you to pay back a withdrawal you made prior to a disaster that you intended to use to purchase or construct a home if you are unable to use the funds because of the disaster. Finally, if you have a company plan that allows for loans, the plan can allow you to borrow a larger amount and give you additional time to repay outstanding loans.

You may also take penalty-free withdrawals from your IRA for “unforeseeable or immediate financial needs relating to personal or family emergencies.” Your employer plan may also allow emergency distributions. These withdrawals are limited to one per calendar year and are limited to $1,000. Once an emergency withdrawal is taken, no other emergency withdrawal can be taken in the following three years unless the original distribution is repaid or future salary deferrals (for plans) or contributions (for IRAs) exceed the amount of the original distribution.

Finally, if your plan allows, you may be able to take a hardship withdrawal from your account. The withdrawal must be for an “immediate and heavy financial need.” Most plans allow employees to automatically satisfy this requirement if their expense fits into one of seven “safe harbor” categories. One of those categories is disaster-related expenses and losses. There is no dollar limit on hardship withdrawals, but withdrawing pre-tax funds subjects you to tax and the 10% penalty if you are under 59 ½.

https://irahelp.com/slottreport/tax-filing-relief-and-retirement-account-withdrawal-options-for-hurricane-victims/

Why Retirement Gets Better With Annuities

Everyone aspires to have a steady source of income after retirement that replaces as much as possible of their pre-retirement earning. But for many people, one big challenge in saving for that goal is to find the right financial product that accommodates their specific requirements, such as when they want to retire or how much more they need over and above their Social Security benefits.

A new research paper by experts at Wharton and elsewhere solves that challenge with a comprehensive evaluation of the moving pieces of retirement planning. The best route is to include deferred income annuities in defined contribution retirement accounts, according to the paper titled “Fixed and Variable Longevity Annuities in Defined Contribution Plans: Optimal Retirement Portfolios Taking Social Security into Account.”

In the U.S., the longer one waits to start claiming Social Security payments, the bigger will be the monthly check. Someone who starts tapping into Social Security at age 62 (the minimum qualifying age) will receive much less in monthly payments than if they were to wait until age 67 or 70.

But the reality is that many people do not delay taking Social Security benefits until they are 70, and so they need a Plan B. “For most Americans, it is financially sensible to delay claiming Social Security until age 70, as this maximizes the retirement payments that they receive for the rest of their lives,” said Wharton professor of business economics and public policy Olivia S. Mitchell, who co-authored the paper with Goethe University finance professors Vanya Horneff and Raimond Maurer. “Nonetheless, most people do not do this, when they cannot or do not want to continue working until age 70.” Mitchell is also executive director of Wharton’s Pension Research Council.

In their research, the authors explore what happens when workers leave their jobs before age 70 while using their retirement savings as a “bridge” to the delayed claiming of Social Security benefits. “We show that most people would be better off if they had access to deferred income annuities in their 401(k) accounts that allowed them to finance consumption while deferring claiming benefits,” Mitchell said regarding their key research finding.

That finding is important in view of recent legislation (the SECURE 2.0 Act passed in December 2022), which encourages employers to include lifetime income payments in their 401(k) plans, Mitchell noted. The SECURE Act specifically recommended the inclusion of annuities in defined contribution (DC) plans and Individual Retirement Plans, also known as IRAs.

A Case for Variable Annuities

Specifically, the paper made a case favoring “well-designed deferred income annuities” in 401(k) accounts, but with an important additional feature. “If plan sponsors could also provide access to variable deferred income annuities with some equity exposure, this would further enhance retiree well-being, compared to having access only to fixed annuities,” Mitchell said. The investment options for a variable annuity are typically mutual funds that invest in stocks, bonds, money market instruments, or some combination of the three.

Equity investments inherently carry risk, but they can deliver significant gains if they are within limits and people make well-informed decisions about those. “Our research shows that including 20%–50% equities in a variable annuity could improve retiree well-being by 15%–20%, for both college-educated and high school graduates, compared to the currently permitted fixed income annuities,” Mitchell said.

In any event, legal barriers currently prevent retirees from going in that direction, since at present, U.S. law does not permit variable annuities in 401(k) accounts. Mitchell noted that “policymakers seeking to improve retiree well-being should consider allowing variable deferred income annuities in retirement plan portfolios.” The paper concluded that “well-designed variable deferred income annuities in retirement plan portfolios can markedly enhance retiree financial well-being.”

Striking a Balance Across Retirement Realities

The study also estimated how much money retirees would need under various scenarios differs according to their gender, education level, and benefit deferral ages (85, 80, and 67) when they begin receiving Social Security benefits. For instance, a college-educated woman who could delay claiming Social Security benefits but lacks access to a fixed deferred income annuity (DIA) requires an additional $17,367 in her DC plan to be as well off, the paper reported. The opposite is true for a female high school dropout: On average, she would be $4,056 worse off if she could not delay claiming but did have a DIA.

For the least-educated people, the preferred option is to delay claiming Social Security, the paper concluded. By contrast, higher-paid better-educated people benefit more from using accumulated DC plan assets to purchase deferred annuities. The authors also considered two other aspects: The least educated also have higher mortality rates, and the Social Security annuity is relatively higher for lower earners.

The most important factor in making those choices is the quantum of Social Security payments one could receive. The Social Security retirement system pays a lifetime annuity with fixed real benefits that depend (progressively) on retirees’ earning histories and claiming ages, the paper noted, setting the backdrop for this research.

Social Security payments are designed around “replacement rates,” or the extent to which they replace workers’ pre-retirement earnings. About 70% of pre-retirement income is considered sufficient by many advisors to maintain one’s pre-retirement lifestyle, and Social Security benefits replace about 40% of the average retiree, according to a bulletin from the Social Security Administration.

Social Security replacement rates are higher for lifetime low-earners, and lower for lifetime high-earners, Mitchell and colleagues noted. “Low lifetime earners receiving a higher replacement rate could decide to devote a greater proportion of their remaining financial wealth to risky equities,” as a result. Retirees with higher lifetime earnings whose Social Security replacement rate is lower could buy larger private annuities from their tax-qualified retirement accounts to secure “a predictable income stream sufficient to cover necessities,” they added.

A Snapshot of the Findings

Below are the main findings of the research:

- Using retirement account assets to purchase at least some fixed deferred income annuities is welfare-enhancing for all sex/education groups examined.

- The better-educated and thus higher-paid men and women benefit far more — 7 to 11 times more — compared to the least educated.

- The better-educated will do better using retirement plan assets to purchase deferred income annuities, versus delaying claiming Social Security benefits by a year and financing consumption from retirement plan withdrawals.

- By contrast, lower-paid and less-educated retirees will do better with the opposite strategy: They will delay claiming and use retirement assets to bridge their consumption needs, versus buying DIAs. This is because lower-paid retirees receive a higher Social Security replacement rate and also face a higher mortality risk, whereas the better-educated receive relatively lower Social Security benefits and can anticipate longer lifetimes.

- Providing access to variable deferred annuities with some equity exposure would further enhance retiree well-being in most cases, compared to having access only to fixed annuities.

https://knowledge.wharton.upenn.edu/article/why-retirement-gets-better-with-annuities/

Final Regulations Allow Separate Accounting for Trusts

Sarah Brenner, JD

Director of Retirement Education

The recent final required minimum distribution (RMD) regulations include a new rule change that may be beneficial for IRA owners who name trusts as beneficiaries. In the new regulations, the IRS allows separate accounting for RMD purposes for more trusts. This can be helpful when a trust has beneficiaries who can potentially have different payout periods under the RMD rules.

Separate Accounting

When an IRA with multiple beneficiaries is split into separate inherited accounts for each beneficiary by December 31 of the year following the year of death, this is considered “separate accounting.” The RMD rules will then apply separately to each inherited IRA. For example, one beneficiary might be eligible to use a life expectancy payout on their inherited IRA while another would be required to use the 10-year rule. Without separate accounting – all of the beneficiaries would have to use the fastest payout method.

In the past, while separate accounting was allowed for multiple beneficiaries named directly on an IRA, it was never permitted for trusts. In many private letter rulings, when a single trust was named as the beneficiary and that trust was to split into three separate sub-trusts, the IRS allowed separate inherited IRAs to be created, one for each sub-trust, but did not allow separate account treatment for RMD purposes. To get around this issue, IRA owners could name separate trusts directly on the beneficiary form. In these situations, the IRS allowed the beneficiaries of sub-trusts to each use their own life expectancy. The difference was that each sub-trust was named as the beneficiary on the IRA beneficiary form, rather than the master trust.

The SECURE Act changed these rules in a limited way. It allowed separate accounting for certain special needs trusts called “applicable multi-beneficiary trusts.” While the SECURE Act limits most beneficiaries to a 10-year payout, special rules for these trusts for disabled or chronically ill beneficiaries allow RMDs to be paid from the IRA to the trust using the beneficiary’s single life expectancy, even if the trust has other beneficiaries who are not disabled or chronically ill.

New Rules

The final regulations expand this treatment beyond “applicable multi-beneficiary trusts” to permit separate accounting to be used for other see-through trusts – if certain requirements are met. Separate accounts may be used for “see-through” trusts if the terms of the trust provide that it is to be divided immediately upon the death of the account holder into separate shares for one or more trust beneficiaries.

To be considered “immediately divided upon death,” the following requirements must be met:

- the trust must be terminated;

- the separate interests of the trust beneficiaries must be held in separate trusts;

- and, there can be no discretion as to the extent to which the separate trusts will be entitled to receive post-death distributions.

In addition, the final regulations clarify that a trust will not fail the requirement to be “divided immediately upon death” if there are administrative delays, as long as any amounts received by the trust during the delay are allocated as if the trust had been divided on the date of the IRA owner’s death.

https://irahelp.com/slottreport/final-regulations-allow-separate-accounting-for-trusts/

Weekly Market Commentary

-Darren Leavitt, CFA

The S&P 500 closed higher for a fourth consecutive quarter, the first time it has done so since 2011. Investors continued to face a challenging macro environment. Escalating tensions in the Middle East, a Longshoremen’s strike, the aftermath of Hurricane Helene, and a packed calendar of economic data and central bank rhetoric, which all contributed to a hectic week on Wall Street.

An eminent retaliation from Israel on Iranian assets seems likely and focused on Iran’s energy infrastructure. The Biden administration appeared to endorse that type of response but pushed back on a plan to target Iran’s nuclear assets. Israel continues a land campaign in southern Lebanon while bombing targets in Beirut and Gaza. The US also destroyed several Hezbollah assets in Yemen over the weekend. The escalation sent oil prices significantly higher and briefly put a bid into safe-haven US Treasuries.

A Longshoremen’s strike that was estimated to cost the economy $4.5 billion a day and perhaps even more if it were to carry on for weeks was thankfully suspended. The two sides will allow more time to negotiate a comprehensive deal but did find common ground on a 61.5% wage increase over six years. On January 15th, the two sides will sit back at the bargaining table to iron out other details, including dock automation and job security.

The death toll from Hurricane Helene increased to 227 across six states, with several other persons still missing. The Category 4 storm is the deadliest hurricane to hit the US since Katrina in 2005. The debate about the Federal government’s response is notable, especially in an election year, and there is no doubt the damage done will have economic ramifications that investors must address. Unfortunately, as I write, Milton has formed into a hurricane in the south Gulf of Mexico, and its trajectory is centering on Tampa Bay with expected impacts on southeastern Alabama, southern Georgia, southeastern South Carolina, and southeastern North Carolina.

The S&P 500 hit another all-time high and added 0.3% on the week. The Dow increased by 0.9%, the NASDAQ advanced by 0.1%, and the Russell 2000 fell by 0.5%.

The real action in markets took place in fixed income and currency markets as investors recalibrated, once again, their expectations around central bank monetary policy. Treasury markets sold off hard on labor data that surprised the upside and on Fed Chairman J Powell’s hawkish comments at the National Association for Business Economics, where he suggested the Fed was in no hurry to make additional rate cuts. The 2-year yield increased by thirty-seven basis points to 3.93%, while the 10-year yield jumped by twenty-three basis points to 3.98%. Fed Funds futures now assign no chance of a fifty basis point cut at the November meeting and a 97.4% chance of a twenty-five basis point cut. The probability of a twenty-five basis point cut may still be too aggressive. The Fed will get another look at the October Employment Situation report before its November meeting along with several other labor-related data sets.

Oil prices soared on escalating tensions in the Middle East. WTI prices increased by $6.25 or 9.2%, closing at $74.40 a barrel. The price of gold was unchanged on the week, closing at $2667.90 an Oz. Copper prices increased by a penny to close at $4.57 per pound. Bitcoin’s price fell by $3500 to $62k while the US Dollar index posted its best weekly move in two years with a 2.1% increase to close at 102.53.

The economic calendar was packed, with all eyes focused on Friday’s Employment Situation report. Non-farm payrolls increased by 254k, well above the estimated 150k. The August and July figures were also revised higher, pushing the 3-month average to 186k from 140k. Private Payrolls grew by 223k, again well above the consensus estimate of 125k. The Unemployment rate fell to 4.1%, down from 4.2%, and the decrease occurred despite increased available labor. Average Hourly earnings increased by 0.4% versus the estimated 0.3%. On a year-over-year basis, wages grew by 4%, up from 3.9% in August. The Average workweek came in at 34.2 hours versus the estimated 34.3 hours. Overall, it was a very impressive report, sending investors back to the drawing board to recalibrate US monetary policy. Initial Jobless Claims increased by 6k to 225k, while Continuing Claims fell by 1k to 1826k. ISM Manufacturing continued to be in contraction mode with a reading of 47.2. However, ISM Non-Manufacturing expanded at the fastest pace since February of 2023 at 54.9, well above the expected 51.7.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

Results From the 2024 Retirement Confidence Survey Find Workers’ and Retirees’ Confidence Has Not Recovered From the Significant Drop Seen in 2023, but Majorities Remain Optimistic About Retirement Prospects

Summary

– However, almost 8 in 10 workers and 7 in 10 retirees are concerned that the U. S. government could make significant changes to the American retirement system –

A new report published today from the 34th annual Retirement Confidence Survey finds workers’ and retirees’ confidence has not yet fully recovered from the significant drop seen in 2023, but majorities remain optimistic about their retirement prospects and the lifestyle they envisioned. The Retirement Confidence Survey (RCS) is the longest-running survey of its kind measuring worker and retiree confidence and is conducted by the Employee Benefit Research Institute (EBRI) and Greenwald Research.

“Overall, two-thirds of the workers and three-fourths of the retirees are very or somewhat confident about having enough money to live comfortably in retirement, which is unchanged from 2023. The survey also shows that workers and retirees are confident that government programs such as Social Security and Medicare will provide benefits of equal value to today and believe they understand the Social Security program,” said Craig Copeland, director, Wealth Benefits Research, EBRI. “Confidence is similar across all ages. But, in some cases, younger workers are actually more confident in certain aspects of retirement. For generation specific results, Boomers and Millennials reported higher confidence in having enough money to live comfortably throughout retirement than Gen Xers.”

The 2024 survey of 2,521 Americans (1,255 workers and 1,266 retirees) was conducted online from Jan. 2-31, 2024. All respondents were ages 25 or older and were prompted to respond to questions about retirement confidence, financial health & concerns, retirement savings & preparation, healthcare in retirement, workplace savings, retirement income, transition to retirement and trusted sources of information.

“Workers and retirees are also concerned that their retirement could be impacted by the U. S. government making changes to the American retirement system. In fact, 79% of workers and 71% of retirees have this concern,” said Lisa Greenwald, CEO, Greenwald Research. “Inflation’s impact on their retirement also remains a concern among workers and retirees.”

Key findings in the 2024 RCS report include:

• Workers’ and retirees’ confidence has not yet fully recovered from the significant drop seen in 2023, but majorities remain optimistic about their retirement prospects. While Americans’ confidence has not returned to prior levels, there are signs that it is making a positive recovery as 68% of workers and 74% of retirees are confident they will have enough money to live comfortably throughout retirement. However, this is not a significant increase from last year. Perhaps contributing to this positive trend upward is workers’ and retirees’ increased confidence in their income. According to the U.S. Census, wage growth is now outpacing inflation growth. Americans are starting to feel this shift as 28% of workers and 32% retirees who are confident feel that way due to their finances. However, inflation remains as a top reason for Americans’ lack of confidence. Among those who do not feel confident, 31% of workers and 40% of retirees cite inflation as the reason why. Additionally, 39% of workers and 27% of retirees who are not confident feel this way due to their lack of savings.

• Social Security remains the top source of actual and expected income for Americans in retirement. Most workers (88%) expect Social Security to be a source of income in retirement. Retirees confirm this sentiment as nearly all (91%) report Social Security as a source of income. However, nearly twice as many retirees (62%) report Social Security is a major source of income than what workers (35%) expect it to be. While most Americans expect/report Social Security as a source of income in retirement, fewer understand it, but those who understand it are a clear majority. Two-thirds of workers and three-quarters of retirees understand Social Security and the various employment and claiming decisions that impact their retirement benefits at least somewhat well. While most claim they understand Social Security, fewer than half of workers have reviewed the amount of their Social Security benefits at their planned retirement age, and 59% have thought about how the age at which they claim Social Security will impact the amount they receive. Expectedly, significantly more retirees than workers have completed either task, with 77% having undertaken each.

• Workers expect to claim Social Security as soon as they retire but also expect to work for pay in retirement. Workers believe they will start claiming Social Security benefits at a median age of 65, which is the same age workers expect to retire. While age 65 has been the historical median age workers expect to retire, significantly more workers (28%) this year expect to retire at age 65. Retirees, on the other hand, report retiring at a significantly lower age than workers anticipate. Most retirees, 7 in 10, report retiring earlier than age 65, with a median retirement age of 62. Also contradicting workers’ expectations, retirees report collecting Social Security later into their retirement but earlier than workers’ expectations at around age 64. Similar to last year, half of retirees say they retired earlier than expected. While 2 in 5 retirees who retired early say they did so because they could afford to, nearly 7 in 10 retirees indicate the reason was out of their control.

• Americans’ retirement calculations result in a desire to save more, as estimations drastically differ from what Americans currently have. Half of Americans have tried to calculate how much money they will need in retirement. In reaction to their calculation, 52% of workers and 44% of retirees started to save more. Even though 7 in 10 workers and nearly 8 in 10 retirees have saved for retirement, this renewed interest in saving is spurred by the drastic difference in what Americans believe they will need for retirement compared to how much they currently have saved. A third of workers who tried to calculate how much they will need in retirement estimate they will need $1.5 million or more. However, a third of workers currently have less than $50,000 in savings and investments. In addition, 14% of workers have less than $1,000 in savings and investments. As part of their retirement preparations, half of the workers have estimated how much income they will need each month in retirement. While a quarter of workers do not know how much pre-retirement income they will need to replace in retirement, an additional quarter of workers believe they will need to replace 75% or more of their pre-retirement income.

• Workers would like help saving for emergencies through their retirement plan. Two-thirds of workers and almost three-quarters of retirees believe they have enough savings to handle an emergency expense. Additionally, almost half of workers have planned how they will cover an emergency expense in retirement. However, the ability to save for emergencies is at the top of workers’ list of valuable improvements they would like to see be made to their retirement savings plan. Some Americans are already using their retirement plans to pay for emergencies as nearly 1 in 5 have taken a loan or withdrawal from their retirement plan. Many of those who took money from their plan did so to pay for unforeseen circumstances such as making ends meet (30%), paying for a home or car repair (17%), and covering a medical expense (15%).

• Workers are more likely this year to want to purchase a guaranteed income product with their retirement savings. Among workers who are offered a workplace retirement savings plan, one-third believe having investment options that provide guaranteed lifetime income to be the most valuable improvement to their plan. This landed second on workers’ list of most valuable improvements to their plan. Significantly up this year, more workers who are contributing to their employer’s retirement savings plan, 3 in 10, expect to use savings from their workplace retirement savings plan to purchase a product that guarantees monthly income for life once they retire. This is substantiated by the fact that 83% of workers who are participating in a workplace retirement plan would be interested in using some or all of their retirement savings to purchase a product that guarantees monthly income.

• While expenses in retirement are higher than some retirees originally anticipated, retirees’ lifestyle in retirement is better than they expected. Significantly up this year, over a third of retirees say their travel, entertainment or leisure expenses are higher than they expected. While half of retirees say their overall expenses in retirement are higher than they originally expected, nearly 4 in 5 say they are able to spend money how they want within reason. Despite higher-than-expected costs, significantly more retirees this year, 3 in 10, believe their overall lifestyle in retirement is better than expected. Additionally, over two-thirds of retirees agree they are having the retirement lifestyle they envisioned. A quarter of retirees strongly agree with this statement.

The 34th annual RCS report can be viewed by visiting www.ebri.org/retirement/retirement-confidence-survey. The 2024 survey report was made possible with support from American Funds / Capital Group, Ameriprise Financial (Columbia Threadneedle), Bank of America, Empower, Fidelity Investments, FINRA, Jackson National, JPMorgan Chase, Mercer, Mutual of America, Nationwide, National Endowment for Financial Education, PGIM, Principal Financial Group, T. Rowe Price, USAA and Voya Financial.

https://www.ebri.org/content/results-from-the-2024-retirement-confidence-survey-find-workers–and-retirees–confidence-has-not-recovered-from-the-significant-drop-seen-in-2023–but-majorities-remain-optimistic-about-retirement-prospects

Recharacterization Still Exists

By Andy Ives, CFP®, AIF®

IRA Analyst

When a traditional IRA owner wants to convert all or a portion of his account to a Roth IRA, he needs to think long and hard about the transaction. For example, some questions to consider:

1. When will this money be needed? Since the earnings on a conversion must remain untouched for 5 years AND the Roth IRA owner must be age 59 ½ before those earnings are tax-free, conversion is a long-term play.

2. What will future tax rates be? If they are anticipated to remain level or go up, then converting now could be a viable solution. But if rates are expected to go down, then it might be wise to reevaluate and possibly postpone a conversion.

3. Where will the money come from to pay the taxes on the conversion? It is often recommended that a person pay the taxes from another source, other than having taxes withheld from the IRA. This way the full amount can begin to grow tax-free.

Why are these foundational questions so important? Because there is no going back. As soon as you hit ENTER on your computer, or as soon as your financial advisor submits the transaction, the deed is done. It cannot be unwound. Recharacterization of a Roth conversion is off the table. (Congress did away with it back in 2018.) Whatever consequences that follow a conversion must be dealt with. Since a Roth conversion is such a major decision, and since conversions are so popular, the common advice is, “Be sure this is what you want to do, because recharacterization is no longer an option.”

This is 100% true – recharacterization is no longer allowed. That is, as it pertains to Roth conversions.

HOWEVER, recharacterization of a traditional IRA or Roth IRA CONTRIBUTION is still available. This is a common misunderstanding. Yes, an unwanted or ineligible contribution to one type of IRA can be recharacterized (changed) to another type of IRA. A traditional IRA contribution can be recharacterized to a Roth IRA, or vice versa. A contribution can be recharacterized for any reason as long as it can be a valid contribution to the other type of IRA.

Why would it be necessary to recharacterize a contribution? Maybe a person made a Roth IRA contribution, but then later in the year earned a big year-end bonus which pushed her over the Roth IRA phase-out limits ($230,000 – $240,000 for those married filing joint in 2024; $146,000 – $161,000 for single filers). Maybe a person made a traditional IRA contribution, but then learned that the contribution could not be deducted based on participation in a work plan.

Regardless of the reason, a traditional or Roth IRA contribution can still be recharacterized. But there is a deadline – October 15 of the year after the year for which the contribution is made. Beyond that drop-dead date, recharacterization is not available. Recognize that when processing a recharacterization, any earnings or losses applicable to the contribution must also be recharacterized. (For example, if you made a $5,000 contribution that was now worth $4,500, only $4,500 gets recharacterized.) Ultimately, it will be as if the original contribution was made to the proper IRA.

While the term “recharacterization” is often dismissed because it “does not exist anymore,” it is imperative to understand that recharacterization is alive and well…but only as it pertains to Roth or traditional IRA contributions.

https://irahelp.com/slottreport/recharacterization-still-exists/

Surprising News About the New Statute of Limitations for Missed RMDs and Excess IRA Contributions

By Ian Berger, JD

IRA Analyst

A big change made by the SECURE 2.0 Act of 2022 was adding a new statute of limitations (SOL) for the IRS to assess penalties for missed required minimum distributions (RMDs) and excess IRA contributions. On its face, it looks like the new SOL is 3 years for the missed RMD penalty and 6 years for the excess contribution penalty. But looks can be deceiving. In fact, for most of you, the new lookback period will be 6 years for both penalties.

The penalty for a missed RMD used to be 50% of the amount not taken. SECURE 2.0 reduced this penalty to 25%, and down to 10% if the missed RMD is timely corrected. This change was effective beginning in 2023. But the IRS can excuse this penalty if you ask for waiver. To do so, you must take the missed RMD and file Form 5329 with the IRS explaining that the RMD shortfall was due to reasonable error.

An excess IRA contribution is a contribution that exceeds the amount you can contribute to your IRA or Roth IRA in a year (e.g., making a Roth contribution when your income is too high or rolling over an RMD.) The penalty for an excess contribution is 6% for each year the excess amount stays in your account as of December 31. There is no penalty if you correct the excess contribution by October 15 of the year after the year for which you made it. The IRS cannot waive this penalty, unlike the penalty for a missed RMD.

Before 2022, most people had no SOL protection, and the IRS could go back indefinitely to assess both penalties. In SECURE 2.0, Congress tried to remedy this by providing new lookback periods for both penalties.

In a recent Tax Court decision, Couturier v. Commissioner, No. 19714-16; 162 T.C. No. 4, the Court ruled that the new 6-year SOL for the excess IRA contribution penalty is not retroactive. Although the Court didn’t address retroactivity of the 3-year missed RMD penalty SOL, the decision almost certainly applies to that penalty as well. This means there will continue to be no SOL protection for either penalty for years before 2022.

For 2022 and subsequent years, the lookback period for the missed RMD penalty for most of you is actually 6 years – not 3 years. The only way to keep a 3-year lookback period for any year is to file Form 5329 with the IRS each year indicating that no penalty is owed for that year and attach enough information to the form to show the IRS why you believed there was no missed RMD for that year. (This is sometimes called “zero-filing.”) But very few people will go to all the trouble to do this. Anyone who doesn’t will wind up with a 6-year lookback if the IRS hits them with a missed RMD penalty.

For 2022 and future years, the lookback period for the excess IRA contribution penalty starts out at 6 years. The only way to get that down to 3 years is to use the zero-filing strategy and provide the backup documentation showing why there was no excess contribution for that year. Once again, this is not something many people are willing to do.

The bottom line: Whether you miss an RMD or make an excess IRA contribution, if you don’t fix it the IRS will have 6 years to come after you.

https://irahelp.com/slottreport/surprising-news-about-the-new-statute-of-limitations-for-missed-rmds-and-excess-ira-contributions/

Weekly Market Commentary

-Darren Leavitt, CFA

US equity markets posted a third week of gains as global central banks continued to cut monetary policy rates. China, Switzerland, Mexico, Hungry, and the Czech Republic cut their policy rates. Chinese markets gained on the news that several funding rates would be reduced and that the government would increase its fiscal spending as needed to meet its growth targets. It’s widely expected that the PBOC will also cut the prime rate soon. The CSI 300 gained 15% for the week, its largest weekly gain since 2008. The shift in policy rates comes as inflation appears to be moderating globally. The Fed’s preferred measure of inflation, the PCE, announced Friday, provided more evidence that prices are indeed trending lower. Better-than-expected earnings results from Micron Technology also catalyzed the market to move higher. The semiconductor sector regained leadership and led the market higher with sizeable moves in influential names such as NVidia, Intel, and ASML. The move was dampened later in the week by news that the DOJ was investigating Super Micro Computer for accounting irregularities and on news that the Chinese government wants Chinese companies to avoid using NVidia’s GPUs.

The S&P 500 gained 0.6% while hitting its 42nd record high this year. The Dow added 0.6%, the NASDAQ rose 1%, and the Russell 2000 shed 0.1%. Yields increased across much of the curve this week as US Treasuries continued to consolidate their aggressive moves since August. The 2-year yield fell one basis point to 3.56%, while the 10-year yield increased by two basis points to 3.75%. Oil prices tumbled 4% despite escalating tensions in the Middle East. WTI prices fell by $2.86 to $68.15 a barrel. Notably, the UAE announced it would likely increase oil production in December. Gold prices increased by $22.00 to $2667.90 an Oz. Copper prices advanced $0.25 or 5.7% to $4.58 per Lb. Bitcoin closed at $65,500, while the US Dollar Index fell to 14-month lows at 100.43.

The economic calendar showed continued progress on the inflation front and telegraphed a resilient labor market. Headline PCE increased by 0.1%, in line with the consensus estimate, while Core PCE inched up 0.1%, which was lower than the anticipated 0.2%. On a year-over-year basis, PCE increased 2.2%, while the Core PCE rose 2.7%. Personal Income increased by 0.2%, shy of the estimated 0.3%. Personal Spending came in line with the consensus at 0.2%. Initial Jobless Claims fell by 3k to 218k, while Continuing Claims climbed by 13k to 1834k. The third look at Q2 GDP showed growth of 3% while the GDP Deflator grew by 2.5%- both in line with the street’s estimates. Consumer Confidence came in a little better than expected at 70.1, while Consumer Sentiment fell from its prior reading to 98.7.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

2024 Pulse of the American Retiree Survey: Midlife Retirement ‘Crisis’ or a 10-Year Opportunity?

Critically underprepared for retirement, 55-year-old Americans enter a crucial 10-year countdown to plan and prepare

- With just a decade until retirement, 55-year-old Americans have less than $50K in median retirement savings

- First modern generation confronting retirement without defined benefit pensions or full societal security benefits

- “Silver Squatters” to rely more on family for housing, financial support

- One-third have already postponed retirement due to persistent inflation

- Women face acute challenges, exacerbated by caregiving duties71% say they are interested in annuities, but only 6% currently count them as part of their retirement strategy

NEWARK, N.J., June 24, 2024 – As a record number of Americans reach the traditional 65-year retirement age in 2024, a younger demographic of critically underprepared pre-retirees begins a 10-year countdown to protect retirement outcomes, according to Prudential Financial, Inc.’s 2024 Pulse of the American Retiree Survey.

Fifty-five-year-old Americans are far less financially secure than older generations, and face mental and emotional strain that extends beyond prevailing notions about the “midlife” crisis. These challenges are exacerbated by calculations that Social Security’s trust funds will be depleted as this generation reaches retirement age in 2035 — making this the first modern generation to confront retirement without full Social Security support, and in most cases without a defined benefit pension plan.

“Attention today is rightly centered on the approximately 11,000 65-year-olds entering retirement every day, but we must also focus as an industry on the opportunity to help a slightly younger generation of workers entering the critical 10-year countdown to retirement. Further, the financial futures of certain cohorts — such as women — are especially precarious,” said Caroline Feeney, CEO of Prudential’s U.S. Businesses. “The upside is that, with the right planning and strategy to protect their life’s work, we can ensure this generation is well-prepared to live not only longer, but better.”

Key findings of the survey include:

- Deep savings shortfall: Fifty-five-year-olds have median retirement savings of less than $50K, falling significantly short of the recommended goal of having eight times one’s annual income saved by this age. Two-thirds (67%) of 55-year-olds fear they will outlive their savings, compared to 59% of 65-year-olds and 52% of 75-year-olds.

- Rise of the “Silver Squatters”: Millennial and Gen Z adults who have counted on parental support will soon be paying their dues: nearly a quarter (24%) of 55-year-olds expect to need financial support from family in retirement — twice as many as 65- and 75-year-olds (12%). One in five (21%) also expects to need housing support, compared to 12% of 65-year-olds and 9% of 75-year-olds. Despite these expectations, nearly half of 55-year-olds (48%) who expect to need support have not discussed it with their family yet.

- Inflation upending everyone’s plans: One-third of 55-year-olds and 43% of 65-year-olds have postponed retirement due to inflation and higher living costs.

- Just scraping by: More than one-third (35%) of 55-year-olds say they would have trouble putting together $400 within one month to cover an emergency expense, compared to 19% of 65-year-olds and 15% of 75-year-olds.

- Women in focus: Across all age groups, women are particularly vulnerable, with less than a third the median savings of men. They are nearly three times as likely to delay retirement due to caregiving duties.

- Retirement funding gap: Amid the broader demise of defined benefit pension plans that supported prior generations, 55-year-olds are nearly twice as likely as 65- and 75-year-olds to rely on “do-it-yourself” employer-sponsored plans like 401(k)s to fund their retirement.

- Untapped annuities opportunity: Despite growing industry recognition of the importance of lifetime income strategies to retirement security, just 6% of 55-year-olds plan to use annuities in retirement, compared to 11% of 65-year-olds and 20% of 75-year-olds. Yet, 71% of 55-year- olds say they are interested in annuities, presenting the industry with a significant opportunity to strengthen their retirement security with protected income solutions.

“America’s 55-year-olds have the opportunity to reimagine and protect retirement outcomes with a new set of tools that can help them safely grow their retirement nest egg while also ensuring a reliable stream of lifetime income,” said Dylan Tyson, president of Retirement Strategies at Prudential. “With the retirement model evolving beyond traditional pensions, lump sums and Social Security, it is critical that we work together to prepare for better and longer lives throughout retirement.”

Midlife Retirement “Crisis”

At an age where they are navigating the most complex balance of career, family and retirement planning obligations, 55-year-olds face the most significant mental and emotional health challenges, particularly if they are financially insecure.

- Feeling “Just OK”: Fifty-five-year-olds are the least satisfied with their lives, rating life satisfaction just 6.2 on a 10-point scale. Seventy-five-year-olds, meanwhile, report the greatest life satisfaction (7.4), followed by 65-year-olds (7.0).

- Money matters: Fifty-five-year-olds who lack financial security are significantly more likely to struggle with mental health (53%) than those who are financially secure (33%).

- Relationship droughts: Forty-five percent of 55-year-olds find it difficult to maintain relationships as they age, significantly more than older generations (31% of 65-year-olds and 27% of 75-year-olds).

ABOUT THE SURVEY

The 2024 Pulse of the American Retiree Survey was conducted by Brunswick Group from April 26 to May 2, 2024 among a national sample of 905 Americans ages 55 (n=300), 65 (n=303), and 75 (n=302). The interviews were conducted online, and quotas were set to reflect a representative population based on age, gender, race/ethnicity, educational attainment, and region. Percentages may not total to 100 due to rounding or multiple choices.

https://news.prudential.com/latest-news/prudential-news/prudential-news-details/2024/2024-Pulse-of-the-American-Retiree-Survey/default.aspx

Eligible Designated Beneficiaries and Disclaimers: Today’s Slott Report Mailbag

Sarah Brenner, JD

Director of Retirement Education

Question:

When an IRA owner dies after their required beginning date, can an eligible designated beneficiary choose either the life expectancy option or the 10-year payout rule?

Answer:

If an IRA owner dies on or after their required beginning date, the 10-year rule is not an option for an eligible designated beneficiary (EDB). The 10-year rule (for an EDB) is only available when the IRA owner dies before the required beginning date. After the required beginning date, the eligible designated beneficiary would have to take distributions over life expectancy.

Question:

Can an IRA beneficiary do a “partial” disclaimer or is a full disclaimer required? Thanks.

Answer:

A beneficiary can disclaim all or part of an IRA that they inherit. A full disclaimer of all the inherited IRA assets is not required.

https://irahelp.com/slottreport/eligible-designated-beneficiaries-and-disclaimers-todays-slott-report-mailbag/

Recharacterization Deadline Approaches

By Sarah Brenner, JD

Director of Retirement Education

It happens. You have made a 2023 contribution to the wrong type of IRA. All is not lost. That contribution can be recharacterized. While recharacterization of Roth IRA conversions was eliminated by the Tax Cuts and Jobs Act, recharacterization of IRA contributions is still available and can be helpful in many situations you may find yourself in.

Maybe you contributed to a traditional IRA and later discovered the contribution was not deductible or maybe you contributed to a Roth IRA, not knowing that your income was above the limits for eligibility. You may recharacterize the nondeductible traditional IRA tax-year contribution to a Roth IRA and have tax-free instead of tax-deferred earnings if your income is within the Roth IRA contribution limits for the year. Or, if your Roth IRA contribution is an excess contribution because your income was too high, you may recharacterize that contribution to a traditional IRA because there are no income limits for traditional IRA contributions.

It’s still not too late to recharacterize your 2023 IRA contribution. The deadline for recharacterizing a 2023 tax year contribution is October 15, 2024 for taxpayers who timely file their 2023 federal income tax returns. This is true even if you do not have an extension. You may need to file an amended 2023 federal income tax return if you recharacterized after you have already filed.

If you decide that recharacterization is a good move for you, contact your IRA custodian. You will need to provide the custodian with some information to conduct the transaction such as the amount you would like to recharacterize and the date of the contribution. Most IRA custodians can provide you with form to collect all the necessary information to complete a recharacterization. The IRA custodian will then directly move the funds you choose to recharacterize, along with the earnings or loss attributable, from the first IRA to the second IRA. This is a tax-free transaction but both IRAs report the transactions to you and the IRS. You will receive a 2024 Form 1099-R from the first IRA and a 2024 Form 5498 from the second IRA.

https://irahelp.com/slottreport/recharacterization-deadline-approaches/

IRA Acronyms

By Andy Ives, CFP®, AIF®

IRA Analyst

When presenting a particular section of our training manual, I usually make the joke that, “if we were playing an acronym drinking game, we would all be on our way to a hangover.” The segment is titled: “Missed stretch IRA RMD by an EDB, when the IRA owner dies before the RBD.” This part of the manual discusses the automatic waiver of the missed RMD penalty in a certain situation, and the acronym soup is borderline comical. So that everyone knows which end is up, here is a spiked punch bowl of common retirement-account-related acronyms.

IRA: Individual retirement arrangement. (Not “account!”)

RMD: Required minimum distribution. Minimum amount that must be withdrawn from a retirement account each year after reaching a certain age.

RBD: Required beginning date (for starting RMDs). Generally, April 1 of the year after the year a person turns 73.

QLAC: Qualifying longevity annuity contract. An annuity whose value (up to $200,000) can be excluded from an IRA owner’s balance for RMD calculation purposes.

EDB: Eligible designated beneficiary. Category of beneficiary who may take stretch RMDs.

NEDB: Non eligible designated beneficiary. Category of beneficiary who gets the 10-year rule.

NDB: Non designated beneficiary. Category of beneficiary that includes “non-people,” like an estate or charity. Payout rules applicable to NEDBs are the 5-year rule or “ghost rule.”

ALAR: At least as rapidly. The rule dictating that when RMDs have begun, they must be continued by the beneficiary. ALAR is a function of frequency, not amount.

QCD: Qualified charitable distribution. A distribution from an IRA to a qualified charity, subject to an age requirement of 70 ½ or older.

CWA: Contemporaneous written acknowledgement. This is just a receipt for your QCD!

CGA: Charitable gift annuity. A one-time QCD of $53,000 (for 2024) can go to an entity like a CGA, CRAT (charitable remainder annuity trust), or CRUT (charitable remainder unitrust).

DAF: Donor advised fund. A QCD cannot be made to a DAF.

NUA: Net unrealized appreciation. Tax strategy used to pay long term capital gains on the appreciation of company stock. (Be sure to know all the NUA rules before proceeding.)

NIA: Net income attributable. The gain or loss on an excess IRA contribution.

QDRO: Qualified domestic relations order. Used to split a retirement plan after divorce.

SECURE Act: Setting Every Community Up for Retirement Enhancement Act.

I feel dizzy. Maybe I should go lie down and sleep it off.

https://irahelp.com/slottreport/ira-acronyms/

Weekly Market Commentary

The S&P 500 notched its 39th record high in 2024 on the back of a fifty-basis-point rate cut by the Federal Reserve. Global central banks took center stage this week, with the Fed playing the headliner. Leading into the Fed’s decision, the street was divided over the magnitude of the cut but agreed that the message surrounding the decision would dictate market action. Notably, the market had a significant bounce in the prior week, and the rates market has significantly rallied over the last several weeks- so it felt like some of the rate cut decisions had already been baked into the market. The Fed’s decision to cut by fifty- basis points was immediately met with a bid into the markets, but that bid faded late in the day as markets settled back to little changed. Fed Chairman Powell cautioned the street’s expectations of continued big rate cuts despite the market pricing in another seventy-basis points of cuts in 2024 and over two hundred more in 2025. The Chairman’s post-decision narrative was constructive and pointed to this fifty basis point cut as a recalibration of rates rather than a cut based on the economy falling into a recession. We think this statement bodes well for risk assets in the future, but we continue to expect continued volatility based on seasonality and into the US elections.

The Bank of England and the Bank of Japan left their policy rates in place. The BOE came across as more hawkish, telegraphing that they are in no rush to cut rates. On the other hand, the BOJ statements post-decision were taken as a bit more dovish and partially closed the door on the idea that the bank needs to raise rates in the near term. The US Dollar lost ground to the Euro and British Pound while strengthening against the Japanese Yen. The Dollar index fell 0.4% to 100.72

The S&P 500 gained 1.6%, the Dow also hit a record high and added 1.8%, the NASDAQ increased by 1.8%, and the Russell 2000 jumped by 2.2%. The broadening out of the market rally continued as the equal-weight S&P 500 index outpaced the market cap-weighted index. Small caps will likely continue to benefit as rate cuts continue, but only in situations where the overall economy is doing well.

US Treasuries took a small step back this week on what feels to be some consolidation of the curve’s recent strong move. The 2-year yield fell by one basis point to 3.57%, while the 10-year yield increased by eight basis points to 3.73%. Oil prices rose by $2.33 or 3.4% to close at $71.01 a barrel. Gold prices notched another all-time high before settling the week up $34.60 to close at $2645.90. Copper prices rose by $0.11 to $4.33 per Lb. Bitcoin ended the week materially higher on the risk-on trade, closing at $63,269.

The economic calendar this week showed a resilient economy. Retail Sales came in better than expected at 0.1%; the street was looking for a decline of 0.2%. Industrial production increased by 0.2% versus the estimated 0.1%. Capacity Utilization came in line at 78%. Initial Claims decreased by 12k to 219k, while Continuing Claims fell by the same amount to 1829k. Housing data also came in better than expected: Housing Starts at 1356k, Building Permits at 1475k, and Existing Home sales at 3.86M.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

NEW SPOUSAL BENEFICIARY RULES AND EFFECTIVE DATE OF 10-YEAR RULE: TODAY’S SLOTT REPORT MAILBAG

By Ian Berger, JD

IRA Analyst

Question:

I inherited an IRA from a younger deceased spouse who wasn’t required to take required minimum distributions (RMDs) until this year. Can I take advantage of the new section 327 rules under SECURE 2.0 since the RMDs haven’t commenced yet?

Answer:

Yes. The recently-released IRS proposed RMD regulations say that section 327 can be used by a surviving spouse who inherits before 2024 as long as the deceased IRA owner would have reached age 73 (the current first year for RMDs) in 2024 or later. The advantage of section 327 is that you can remain an IRA beneficiary (as opposed to doing a spousal rollover) and use the IRS Uniform Lifetime Table (and your age) to calculate RMDs. This will produce smaller RMDs than if you were using the IRS Single Life Table, which was required before section 327. An added benefit of being a spouse beneficiary is that these RMDs will not start until the deceased spouse would have been age 73. (As an alternative, you could elect to have the inherited IRA emptied by the end of the 10th year following the year your spouse died. No annual RMDs would be required in years 1-9.)

Question:

My father passed away in March of 2018 and I inherited his 401(k). I rolled over the 401(k) to an inherited IRA. Do I have to liquidate this IRA by the end of 2028?

Thank you.

Rick

Answer:

Hi Rick,

No. The 10-year payment rule for inherited IRAs applies to most non-spouse beneficiaries (including adult children) of IRA owners who die after 2019. Since your father died in 2018, you aren’t subject to the 10-year rule. You can continue taking annual RMDs over your single life expectancy.

https://irahelp.com/slottreport/new-spousal-beneficiary-rules-and-effective-date-of-10-year-rule-todays-slott-report-mailbag/

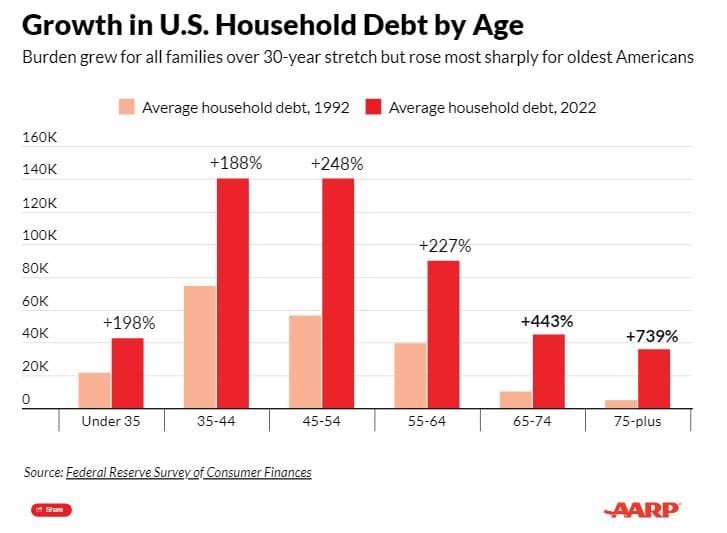

Federal Reserve data shows sharp rise in amount Americans 65 and older owe

Americans across generations are carrying more debt than they did three decades ago, according to Federal Reserve data, but the rise has been especially steep among the oldest age groups.

The Fed’s most recent Survey of Consumer Finances (SCF) found that among all groups younger than 65, debt roughly doubled from 1992 to 2022. That’s in line with inflation over that time.

But debt more than quadrupled in households headed by people aged 65 to 74 in that period (from $10,150 to $45,000 per household, on average), and for those 75 and up it has increased sevenfold (from just under $5,000 to $36,000).

Older adults are also considerably more likely to have debt now than they were a generation ago. Fifty-three percent of households headed by someone 75-plus had debt in 2022, compared to 32 percent in 1992. For the population at large, the increase was just a few percentage points.

“There are a lot of folks who just don’t have enough money put away,” says Jason Athas, manager of educational programs at Debt Management Credit Counseling Corp., a Florida-based nonprofit that provides debt relief and counseling services.

As a result, he says, he is seeing more older adults struggling to keep up with their costs. Research by AARP and others bears him out.

An October 2023 AARP study found that 65 percent of people 65 and older who have debt consider it a problem, including 29 percent who call it a major problem. According to a July 2024 report from the Nationwide Retirement Institute, a research and consulting arm of the insurance company, nearly a third of retirees expect to be less financially secure in retirement than their parents or grandparents.

“Credit card debt is one of the biggest problems seniors have today,” Athas says.

Inflation impact

Household debt among those 75 and older has declined since 2010, when it more than doubled to nearly $41,000 on average in the wake of the Great Recession, according to the SCF, which the Fed conducts every three years. Their debt had declined sharply by 2013 but has risen steadily since, subsequent surveys showed.

Runaway inflation in 2021 and 2022, and the Federal Reserve’s campaign to tamp it down by sharply raising interest rates, have played a part, financial professionals say.

“We’re all impacted by the accelerated cost of living,” says Hector Madueno, financial education manager at SAFE Credit Union in Northern California.

While painful for all consumers, higher prices are more easily absorbed by people in the workforce because wages typically rise in tandem with prices. “Retirees are less likely to have this buffer,” says Fred Perez, chief lending officer at Southern California’s First City Credit Union. The ultralow interest rates in place before the inflation spike also contributed to higher debt by prompting more older homeowners to tap into their accrued housing equity.

“Part of why we’re seeing more mortgage debt at older ages is [because] the nature of how people manage their debt across a lifespan has changed,” says Lori Trawinski, director of finance and employment at the AARP Public Policy Institute.

“There’ve been a lot more refinancing opportunities that didn’t exist in the ’60s and ’70s, so now it’s rare for someone not to refinance their mortgage if they’re in their home a long time,” she says. “People have become much more used to carrying a mortgage into their retirement years.”

Mortgages account for roughly three-quarters of the debt held by Americans 70 and older, according to a May 2024 report from the New York Fed.

Recession legacy

Economists and financial advisers tend to broadly segment debt into “good” and “bad” categories. Low-rate and fixed-rate debt such as mortgages are generally considered less worrisome than revolving, high-interest debt such as a credit card balance.

As a credit counselor in the aftermath of the Great Recession, Athas saw people rely on credit cards after job losses. Older workers in their peak earning years struggled to rejoin the labor force and attain their former income. For many, the result was a legacy of debt.

Today’s high interest rates are exacerbating that, he says: “If they’re carrying a balance and not paying it off, they’re getting hit with a good amount of interest on that debt.”

Nearly half of boomers have credit card debt, and nearly two-thirds have been carrying it for more than a year, according to a June 2024 Bankrate survey.

Even so-called good debt like home loans can pose a unique threat to the oldest borrowers because they have fewer options to increase their income if they find themselves struggling to make payments.

Nearly 40 percent of people 80 and up pay at least 30 percent of their income on housing, compared to 32 percent of the overall population, says Jennifer Molinsky, director of the Housing and Aging Society Program at the Harvard Joint Center for Housing Studies.

Borrowers who have already tapped their home equity or taken out loans to manage older debts without changing their spending habits risk digging themselves in deeper, Perez says. “They don’t curtail their spending. That’s a particularly troublesome concern.”

Steps to rein in debt